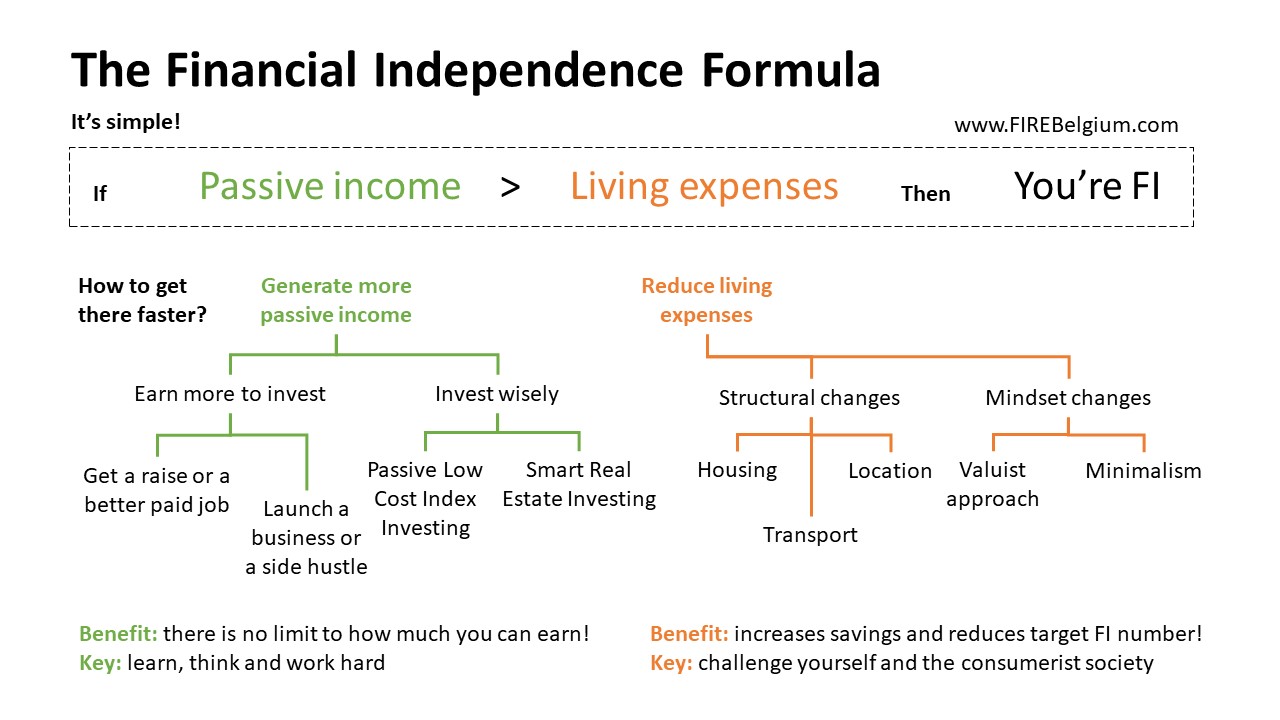

What is the simplest way to both represent Financial Independence and explain how to get there? That’s the question I was asking myself when developing this diagram. I wanted to represent the concept in a simple way so that very beginners would understand.

So, if you’re a beginner, I am hoping you will find this useful!

When you think about it, the financial independence formula is pretty simple:

Passive income

>

Living expenses

When your passive income exceeds your expenses, you’ve reached financial independence. (Wow, so smart! :-P)

Passive income is income that comes to you without you having to trade time or work for it. Instead of trading time and work for money, we invest time, work and money to build assets. Those assets in turn generate income which can be reinvested to build more assets. If invested wisely it can compound over time and generate passive income.

To make this formula work for you, you need your passive income to exceed you living expenses. You can work on both sides of the formula:

- Reduce your living expenses

- Build more assets to generate more passive income

The best way to get there is of course to work on both of them. Let’s look at those two in more details.

Reduce living expenses to reach financial independence faster

The double power of cutting back expenses

Cutting expenses is often the first step we take to get closer to financial independence. This is often referred to as frugality: the quality of being economical with money and other resources.

For those of us who already have a fairly comfortable lifestyle, cutting unnecessary expenses is often how we can make the most progress, in the short term. That’s because many of us have more control over our expenses than over our income, especially if we start from a point where we live without paying much attention to our spending.

If we’re already living with the bare minimum, it’s often hard to cut back further, in which case it makes sense to solely focus on finding ways to earn more first, while keeping control over our expenses.

Reducing expenses has two direct benefit for someone aiming for financial independence:

- As you reduce expenses, you increase your savings and therefore the amount of money you can invest. This helps you acquire assets faster and generate more passive income.

- As you reduce expenses, you move to a new way of living and spending and hence reduce the amount of passive income required to cover your expenses, which means the target size of your portfolio of assets (or your “FI number”) can be decreased as well, making financial independence closer.

So, in addition to the many benefits of living a simple (and even minimalist) life, it will also lead you to reaching financial independence much faster. This is the double power of cutting back expenses.

The key is to find the balance between your possessions, your expenses and your priorities in life. Reducing your expenses too far could also impact your life negatively. It is important to keep in mind that money is only a tool and so saving should serve only to make your life better. There is therefore a limit to how much you can and should save, so that you not only optimize for your future well-being, but also your present well-being.

Mindset changes: Finding the balance with the valuist and minimalist approaches

Finding the balance between our present and future well-being is actually the key to reduce living expenses. I love the way Brad from ChooseFI summarizes this simply as being a valuist: “In terms of financial independence, a valuist is someone who spends money on experiences or things that they truly place value on. Being a valuist is simply choosing to live one’s life with intentionality.”

So the key question to reduce living expenses, is rather a counter-intuitive one: What do I value most? What matters to me most? The valuist approach is to focus our spending on that, and reduce our spending on the rest.

For a valuist that places some importance to the quality of his/her future life, saving and investing comes high in the prioritisation of values. The money that could be used to upgrade your car or move into a larger home can be invested, and over time, grow to a level that makes a big difference in your financial independence journey. The power of compounding can be really incredible, especially when used to create resilience and freedom!

So, as valuists, we want to live a comfortable life, but we also want to save and invest for the future. It’s about finding the balance between our present wants or needs and our quest for a life with more control and freedom in the future.

And when we think about expenses, what we value deep down is often not those products or services specifically, but part of the experience they bring us. As valuist, we will therefore focus on that experience, find ways we can get it for cheaper if we can, and invest the difference to build the future we want.

Here are 3 questions to help you maximise the value of your money when making a spending decision. I call them the valuist questions:

- What do I value most in this expense or transaction?

- Are there ways to get similar value while spending less? (Note: “no” is also a valid answer in some cases!)

- How does this compare with the value of increased freedom generated by investing this money instead?

Technically, we need to consider all expenses and ideally we should make both big changes and small changes.

Another way of approaching this mindset change is to embrace minimalism. As Joshua Fields Millburn & Ryan Nicodemus define it, minimalism is “a tool to rid yourself of life’s excess in favor of focusing on what’s important—so you can find happiness, fulfillment, and freedom.” It’s about focusing and making space for what is essential in our lives both in terms of possessions and experiences. That in turn helps us save more, enjoy what we have more and progress towards financial independence faster.

Structural changes

Often, our big expenses are related to the way our life is structured. While it is influenced by financial considerations, the structure of our life is rarely optimized for financial independence. This means that there are structural changes that can greatly increase your savings and accelerate your path to financial independence. They’re often more difficult to change but they’re also where we can make the most progress, so they’re worth focusing on with more intentionality.

Here are some examples of structural changes to consider:

- Housing: this is often one of the biggest expenses we have. And it is often far from being optimized for financial independence. Asking the valuist questions will help you determine whether smaller/cheaper place would bring you value as well. (In my own example, at some point I moved from my own studio to a shared house with friends: it greatly enriched my social life and helped me reduce some expenses!)

- Transport: another important expense, often underestimated. Consider this: would you get the same value with a smaller/cheaper/2nd-hand car? What about other modes of transportation? (At some point on the journey I sold my car and move to public transport + car-pooling, while it took a bit of logistics to organise it, I was actually getting to work in a similar time (because I was now avoiding some of the traffic) and I had a much better quality commute (time for podcast in the metro and social time while car-pooling)

- Location: This ties in with the 2 above. Moving can be a great way of:

- 1) reducing transportation distances, time and money spent by moving closer to work

- 2) increasing earning potential (for example if you’re willing to move to a place where job opportunities are more interesting – this was my case)

- 3) reducing general cost of living by moving to an area with lower costs of living.

Generate more passive income

No upper limit

On the other side of the financial independence formula, there is passive income. While there is a limit to how much you can cut expenses, there is virtually no upper limit to how much income and passive income you can generate.

Because of this scaling effect, it is important to focus on generating more revenue, and on learning how to invest more effectively. While cutting expenses is (relatively) easy to start with because we often have direct control over it, increasing revenue takes more time and dedicated effort, but it’s definitely an area we cannot neglect: we have to build assets.

An asset is a resource with economic value that you own or control and that will provide a future benefit (e.g. income). There are many kinds of assets, but to keep this article simple, we will mainly consider 4 types of assets:

- Your capacity to earn (your career): for many young people, their time, ability to learn and earn more in the future is their main assets. And in many cases, this is the asset that enables everything else later in life. Don’t neglect it.

- Real estate investments: this is the asset most people understand. We either pay rent to someone or we own. If you get other people to pay rent to you and it exceeds your cost of ownership, then you have an asset.

- Stock market investments: this is my favorite asset because when done well, it’s highly performant and 100% (as opposed to the other assets discussed here)

- Business or side-hustle: this is when you decide to work for yourself as your main activity or on the side of your main job. There are tons of ways to build businesses and we are not going to go into much details here. But the main idea is that you can earn an income or build a “work” asset outside of regular employment.

Earn more to invest

While there are exceptions, most people achieve financial independence by earning more, building businesses, investing in real estate or investing in the stock market. Often some combination of the four. Note that all of them can be great ways to increase wealth, but they’re not all passive income. Here are more details on the main strategies:

Get a raise or a better paid job

This is often overlooked because we’ve been in this business and this job for a long time and we’ve always been paid the way we are. Unless we come across examples of people around us that are earning significantly more for similar work/responsibilities, we don’t really spend much time asking the questions: Should I be earning more? How can I earn more?

When we’re young, our jobs are our most precious asset. When someone in his/her twenties or thirties looks at their earning potential in the future (even without including significant pay raises), we often find that this potential is much greater than any other asset we own and often far greater than our current net worth.

In this case it makes sense to focus on increasing our earning potential. The earlier we can increase our salary (and corresponding responsibilities) the larger the impact on our total earning potential. This is because the effect of a significant pay increase early in our career tends to have an effect throughout our career.

Here are several ways to increase how much you’re getting paid:

- Provide more value: the better we are at what we do and the more valuable we become to our employers, the more likely we are to get paid better. And I believe we have better chances at providing value if we become good at solving an important problem.

- Select or change towards a higher paying role or industry

- Increase your value and productivity by focusing on what matters most at work (i.e. with the 80/20 rule)

- Know your value and ask to be compensated accordingly.

Early in life, it’s important to invest time and money to increase your earning potential, both by acquiring the rights skills and competences and developing your network.

Launch a business or a side-hustle

If you have an entrepreneurial spirit, you can decide to invest your time and resources in your own business. Traditionally, this is how most self-made billionaires have become wealthy. This is a high-risk high-reward approach to building wealth. Some people spend their lifetime launching startups and building businesses without ever becoming wealthy or generating passive income. Some other (in very rare cases) become millionaires in just a few years. If done well, entrepreneurship is potentially the fastest way to becoming wealthy. Once you’ve built a business, you can either delegate the management and try to make it passive (this is not an easy process), or you can sell it and generate passive income by investing the proceeds intelligently.

If you’re interested in starting a business, with as little upfront investment possible, I highly recommend checking out the Rebel Business School and their free business startup course. And a great place to learn about starting an online business is Smart Passive Income.

Smart real estate investing

Investing your savings in real estate is the most common, and most widely understood way to generate passive income. You purchase properties and rent them out. The rent pays for the mortgage, the running costs, and hopefully also generates a surplus . But be careful, if you do most of the work yourself, and trade time for money, that’s not passive income. If you’re paying a competent property manager that handles most issues, then the remaining profit can be called passive income.

I am not a real estate investor and so I am not going to write much about this topic. If you’re interested in learning more about real estate investing, I highly recommend learning with Bigger Pockets. Another great place to learn is Paula Pant’s website and podcast Afford Anything.

Passive low cost index investing

Investing your savings in the stock market is a method that seems to be less understood in most parts of the world. This is mostly because the stock market is depicted in the media as a risky way to make money, often compared to gambling money in casinos.

Another reason is that investing in the stock market used to be something only the very wealthy could do. But thanks to the work of John C. Bogle, the founder of Vanguard Group, and the rise of index funds (in both mutual fund and ETF forms) and online brokers, investing is now something almost anyone can do. If you follow the simple and effective Bogleheads’ approach to investing, then you can expect long term return between 6 and 9%.

Accounting for inflation, and using the 4% rule of thumb, the retirement community has calculated that if you withdraw between 3 and 4% of your portfolio every year, the portfolio has high chances of enduring forever. That’s how we generate passive income from the stock market. For every 1,000 USD invested wisely, we calculate that it can generate between 30 and 40 USD per year forever. So, if you have 25 to 33 times your annual expenses invested Bogleheads style, you’re financially independent!

If you’re interested in learning more about index investing (especially if you live in Belgium), I recommend you watch my free workshop on Index Investing for Beginners and make sure you get your free copy of my Beginner’s Guide to Index Investing.

In addition to the Bogleheads wiki and forum, I also highly recommend JL Collins Stocks Series as well as his excellent book: The Simple Path to Wealth. Make sure you also join the FIRE Belgium communities on Facebook and Meetup.

Hi Sébastien,

First of all congratulations on your 4 year celebration on being FIRE! Great achievement.

I’ve been listening to your FI presentations and am interested in trying out the FI calculator. I can’t find it on the website of on a link mentioned in the video.

Could you share it with me?

Thanks in advance and looking forward to realising an early retirement as well, although I love my work and don’t want to stop, but having the option and freedom appeals to me :-).

Pieter van Galen

Hi Pieter, Thank you! You can check out the video explaining the FI Formula and calculator here.

Also, you can get the free calculator here: https://bit.ly/FIREcalc