13 Ways to Take Money Out of your Company

By Bryan Prieto-Duran

How to attend the next events for company owners in Belgium: Join the Investing as Self Employed in Belgium community

Connect with Bryan Prieto-Duran:  / bryanprietoduran

/ bryanprietoduran

Connect with Sébastien Aguilar:  / sebastienaguilar

/ sebastienaguilar

As a business owner, optimizing how you take money out of your company is essential for maximizing personal wealth and minimizing taxes.

While each approach has pros and cons, understanding your options can help you retain more of what you earn.

Below, I break down 13 ways to draw funds from your business in a tax-efficient manner.

But before we start, it’s important to understand why you should read this article, besides the obvious goal of paying less tax.

Who am I?

- I worked for 10 years in finance as a Wealth Expert and Head of Sales.

- I specialize in reducing taxes and increasing wealth for business owners.

- I have helped over 3,000 clients throughout my career.

- I trained over 25 Wealth Experts.

- I transitioned from optimizing earned money to generating new income by providing consistent, qualified leads on autopilot through LinkedIn.

Now, instead of only advising business owners on optimizing already-earned income, I focus on generating new revenue. I realized there is a limit to how much money you can optimize, but no limit to how much you can earn.

So…

Every self-employed person pays personal income tax.

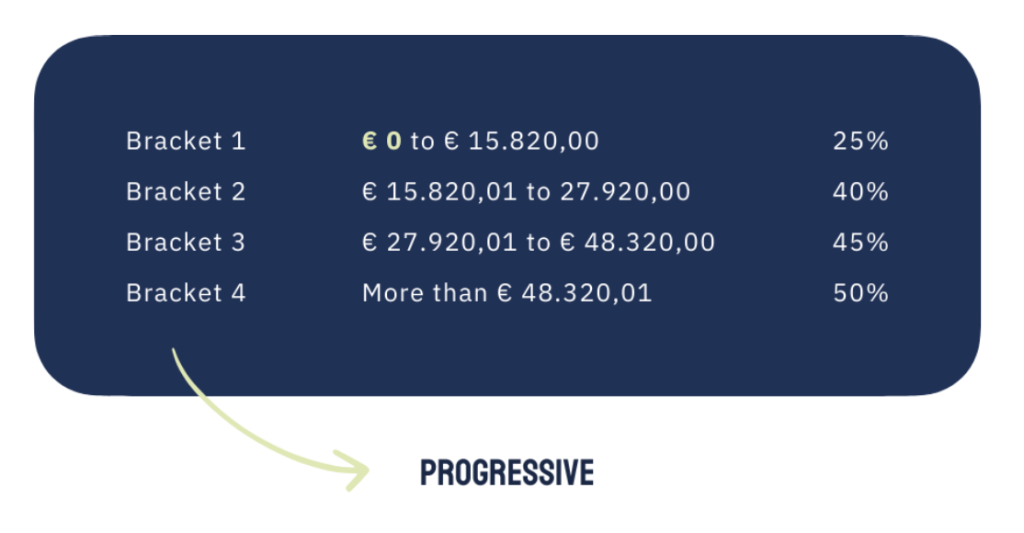

These are the brackets for 2024:

The brackets are progressive, which means that you pay a higher percentage only on the amount in that bracket, the more you earn.

There is also a tax-free allowance of €10,570, which is added to the first bracket. Depending on your situation, like how many kids you have, that allowance increases.

So, do you earn €30,000?

The difference between your tax-free allowance and €15,820 is taxed at 25%.

From €15,820 to €27,920 is taxed at 40%, and so on…

This is how you want to look at the brackets:

The moment you enter a new bracket, look for ways that have a lower tax rate than the rate of that bracket.

So let’s say you enter the second bracket. Instead of accepting the 40% on every euro that is in that bracket, take a look at the list below.

If you find something that has a lower rate, and you are eligible for it, you could consider that instead of a wage increase.

Always make sure that you are eligible before implementing. Talk to an accountant or a firm that specializes in tax optimization to verify or conduct the required research.

1. Wage (50%)

One straightforward way is through wages. Wages are subject to personal income tax, ranging from 25% to 50% based on progressive tax brackets. While taxes are unavoidable, structuring wages wisely within a tax bracket that aligns with your lifestyle needs can be beneficial.

2. Net Compensation (0%)

Certain expenses can be reimbursed tax-free. Known as net compensation, this includes necessary business expenses covered personally, such as mileage. It’s a way to extract funds without increasing your taxable income.

Summary:

- Expenses paid privately

- Strict regulation

- Business expenses

- Business trips:

- €20.8/day

- Min 6h on the road

- Max 16 days per month

- Can’t combine with Meal Vouchers

3. Meal Vouchers (Approx. 35%)

Meal vouchers provide a small but consistent tax-efficient withdrawal. The company can cover €6.91 per working day, with €2 deductible.

Summary:

- Max €8 per working day

- You pay €1.09 yourself

- Only €6.91 by company

- Of which €2 deductible

- The remaining €4.91 is a Non-Deductible Expense, which means you pay company tax on it.

- €100 => €65

4. Second Pillar Pension (Approx. 20%)

Contributing to a second-pillar pension plan reduces immediate tax liabilities and secures a future income stream. If managed correctly, this plan can serve as a long-term, tax-optimized investing route, especially if it’s allowed to grow over time.

Summary:

- Company pension plans

- Like IPT (NL) / EIP (FR)

- Long term, unless used for real estate investments.

- €100 => €80

- Some companies have the option to invest in ETFs within the IPT / EIP.

5. Liquidation Reserves (31.6%)

Liquidation reserves can be retained profits, held in reserve, and withdrawn at a lower rate after five years, effectively reducing tax impacts compared to dividends.

Summary:

- After company tax

- So it’s 20 or 25%, then 10% and then 5%

- Total = 31.6% (with 20% company tax)

- Duration is 5 years (wait time)

- Inflation kills the wait period, solutions:

- DBI = risk increase company tax

- Branche 6

- €100 => €68.4

6. Dividends (44%)

Dividends are taxed after company taxes, typically at 44%, making them relatively less attractive. However, they offer a straightforward way to profit from retained earnings if other options are maximized.

Summary:

- After company tax

- So it’s 20% or 25%, then 30%

- Total = 44%

- Immediately available

- Expensive

- €100 => €56

7. Dividends VVPR Bis (32%)

For small companies, the VVPR Bis dividends are taxed at a reduced rate of 32%. This offers significant savings for smaller firms that meet specific eligibility criteria.

Summary:

- After company tax

- So it’s 20% or 25%, then 15%

- Total = 32%

- Immediately available

- Age company must be 3+

- Beneficial

- €100 => €68

8. Warrants (Approx. 30%)

Warrants offer a flexible approach to extract funds over time. But they are also very complex to set up.

Summary:

- Before company tax!

- Immediately available (after 12 months)

- No age restrictions

- Type of “bonus” on top of your wage

- Complex

- Beneficial (especially when company tax is 25%)

- €100 => €70

9. Reconstitution Loan (Approx. 20%)

A reconstitution loan allows you to use gross revenue to buy real estate privately.

Summary:

- Pension plans as a collateral

- Buy real estate privately

- Pay with gross revenue from your company

- Funds + real estate + rent + tax reductions

- Complex

10. Share Transactions (0%)

This is an appealing option when your business gains value over time.

Summary:

- Company needs to be valuable to others

- 0% when you own the shares of your company privately

11. Copyrights (7.5% – 15%)

Copyright income, relevant for creatives, is taxed at reduced rates from 7.5% to 15%. This option suits those whose work includes intellectual property like books, media, or digital assets.

- Creation like photo, video, books, art, etc.

- Strict

- Under pressure

12. Current Account (30%)

Using your current account enables your company to borrow funds from you. While it’s an option, it may come with a 30% tax and needs a well-managed balance sheet to remain beneficial.

Summary:

- Debt you or your company has

- Only beneficial when your company has the debt

- Depends on Equity

- 2024 = 8.02%

- Beneficial when you have too much savings and don’t want to invest

13. Renting Property (Approx. 30%)

If you own a property and rent it partly to your business, the rental income can be advantageous.

Summary:

- Rent a part of your home to your company

- Calculated based on a formula

- €100 => €70

Final Thoughts

Each of these options has unique tax implications and should be chosen based on your personal and business goals.

It’s wise to consult with a financial professional to tailor these strategies to your needs, since details and rates can change over time.

You can also learn more about personal finance for business owners in Belgium on our free community: Investing as Self Employed in Belgium

And make sure to connect with Bryan Prieto-Duran:  / bryanprietoduran

/ bryanprietoduran

And Sébastien Aguilar:  / sebastienaguilar

/ sebastienaguilar