If you have a foreign account, either as the sole account holder or as a joint account holder, it is necessary for...

Welcome

FIRE Belgium

Learn to take control of your finances and invest better

so that you can live more and give more.

FIRE Belgium is here to help you build financial security and pursue financial independence through education and the power of community.

What we do

What is FIRE Belgium

FIRE Belgium is a personal finance education business and community based in Belgium.

We are here to help you build financial security and financial freedom, one step at a time.

We use simple and effective methods to take control of our finances and progress towards Financial Independence and Early Retirement (FIRE).

What We Offer

What YOU will Learn

Unlock Freedom

How good personal finance can unlock incredible freedom in your life

Earn & Save

How to earn and save more

Invest Effectively

How to invest effectively for the long term

Create Freedom

How to create freedom and options in our lives

Financial Independence

How to plan for financial independence

Financial Independence

How to plan for financial independence

What Our Meeting Looks Like

Meet OUR Team

What we Offer

What is Financial Independence?

You’re financially independent when you have enough wealth or passive income to pay for your living expenses for the rest of your life. You don’t need to to work for money and you don’t depend on others financially.

While often presented as a goal, financial independence is a journey.

Most people start by being highly dependent on their job (or on others) for income. As you learn to take control of your finances, you gradually build financial security and then financial freedom in your life up. Step by step you improve your financial situation until the point where have the choice to quit your job without having to worry about money.

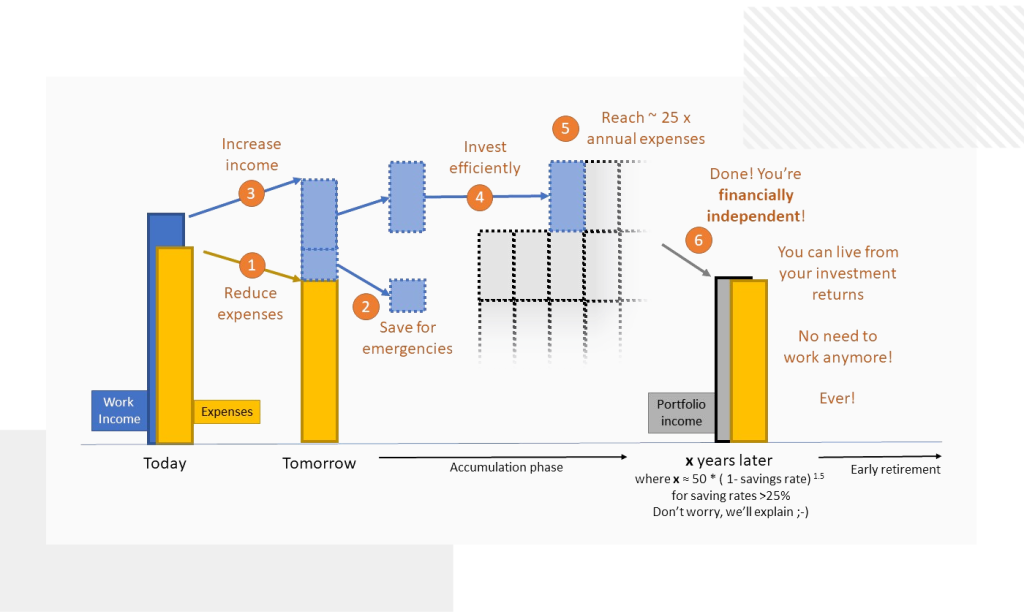

Our Simple Process

The SIMPLE Path to Financial Independence

It’s NOT about depriving yourself and cutting out everything (like the media often presents it), it’s about spending money on what you value in an efficient way. Reducing expenses is often the easiest and quickest way to boost our savings. Optimizing your spending can help you build some financial security fast!

This is so that you have a buffer for when something unexpected (and expensive) happens. This is your first line of defense (social security is part of your defense too).

This is the other way of increasing your savings. It’s usually harder to do but it’s well worth spending time figuring this out. While there is a limit on how much you can cut your spending, there isn’t one on how much you can earn (provided you are willing to learn and work for it).

This is an essential part of the FIRE approach. You want your savings to work hard for you, in a way that is sustainable in the long term and that matches your risk capacity. Here we like index investing because it’s probably the most efficient way to build wealth completely passively.

This is based on the 4% guideline often used in the FIRE community. It’s just a guideline which needs to be adapted to your personal situation (age, other sources of income, pension, social security, etc.).

This is when you do not depend on your job income to pay for your living expenses. You can live off the returns of your investments, doing minimal work. When you’re FIRE, you can choose what to do with your time, without money being a major constraints. You can choose to travel, enjoy your hobbies, spend time with your loved ones, start a passion project or you can choose to continue to work. The goal is for you to find what brings you fulfillment (and doing nothing rarely achieves that 🙂

At FIRE Belgium, we believe money and financial independence are great tools to building a fulfilling life. We see investing and financial independence as enablers for good. With increased control on our finances, we create choice and opportunities in our lives. And with increased financial security, all the way to financial independence, we unlock superpowers that can help make the world a better place.

We believe this simple knowledge is for everyone to benefit from, and we aim to bring it to everyone in Belgium.

Learn More

What is Index Investing?

Index investing is probably the simplest and most efficient way to invest and benefit from compound growth over the long term.

It’s an approach that is based on evidence and academic research that leads to better performance than what the vast majority of investment professionals can achieve. It has been developed by investors like you and me, to serve investors like you and me. It’s based on a set solid principles and is much simpler to learn and implement than what the financial industry wants you to believe (of course thay would rather you rely on (and pay) them. But the truth is, you’re often much better off, skipping their investment advice and investing through 1 or 2 index funds and holding them long term. All the research show that this is the most efficient way to get the best results over the long term at minimal cost.

To learn more about index investing, we recommend you read our Beginner’s Guide to Index Investing and participate in the Index Investing for Beginners Workshop.

Join Us!

Workshop: Index Investing for Beginners

Learn how to create passive income from the stock market using index funds, ETFs or trackers, without having to pay high fees to banks or advisors, taking unnecessary risks or spending all day analyzing the markets.

By Sebastien Aguilar – Founder of FIRE Belgium

Join Us!

The Beginners Guide to Index Investing

The 10-step proven strategy to get started. I have developed this guide to help complete beginners take control of their finances and prepare themselves for index investing.

Join Our Community!

Join the Financial Independence Belgium Facebook Community

Join a group of like-minded people. Ask questions, share your experience. Together we can do so much more.

And if you’re not on Facebook, you can always join our Meetup group.

Start Learning Now!

Most POPULAR Articles

How to declare foreign accounts in your Personal Tax return

When you hold a foreign broker account, you must include it each year in your (Belgian) personal income tax return. (Not declaring...

The 5 things that helped me reach financial independence at 33

I am so blessed with having been able to reach financial independence at 33. Since then, for the past five years, I’ve...

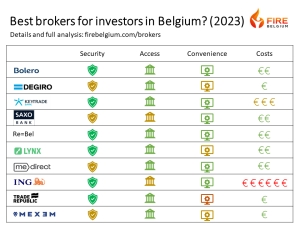

Best brokers for investors in Belgium (2024 update)

What are the best brokers for investors in Belgium? Which ones are the cheapest?Which ones are the safest?Which ones are the easiest...

How to pick your broker? (investing from Belgium in 2023)

I know an investor who had to pay 70,000 euros in penalty fees because he was investing with the wrong broker. And...

I get asked a lot how I managed to reach FI at 33 years old

Recently, someone I respect a lot, asked me on LinkedIn: “How on earth did you retire at 33??” I know it sounds...