I know an investor who had to pay 70,000 euros in penalty fees because he was investing with the wrong broker. And his portfolio was worth less than 50,000 euros.

The broker you pick is a crucial part of your investment strategy. Getting the wrong broker could be very costly.

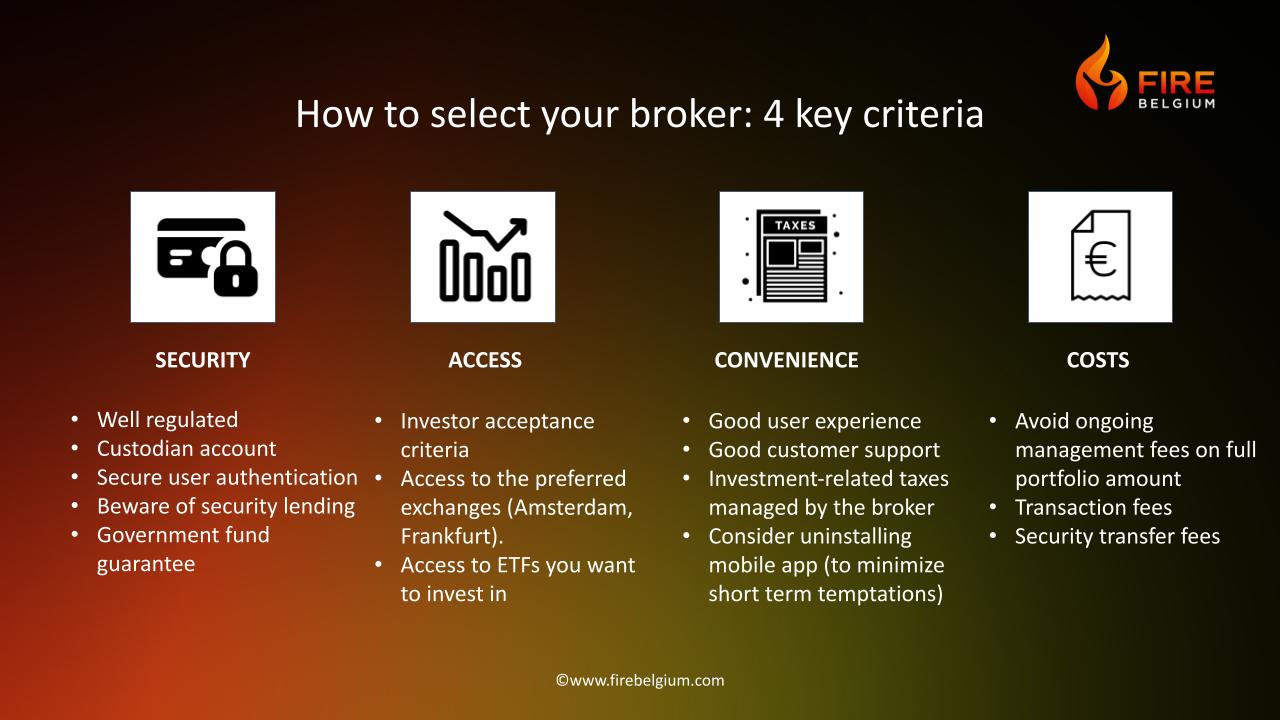

Here are the 4 most important criteria to select your broker:

- Security

- Access

- Convenience

- Costs

In this article, we explain how you can select the perfect broker for your investing, without making the beginner’s mistakes.

How to select a broker for beginner investors

“What’s the best platform to invest?”

“What is the best broker in Belgium”?

“What is the cheapest broker?”

These are often the first questions complete beginners ask first. And while picking the right broker is important, it should not be the first thing to think about.

In fact, which broker to use should be the last question you answer when you start investing.

Here is a list of things you have to figure out first:

- Your financial goals

- Your investment philosophy

- Your risk capacity and asset allocation

- Taxes and other legal obligations

- Your investment strategy (which includes your investment choices, rebalancing approach, etc.)

Only after all that, you should worry about the choice of broker.

I explain how to develop your investment approach and how to get started with index investing in this free workshop on index investing for beginners.

Another beginner mistake I see often is that people pick their brokers based on fees, alone. I think that’s also a mistake.

Fees do play a role, and yes we need to pay attention to them, but the most important parts of investing are security and safety.

Low fees sometimes come at the expense of important security features and low-cost platforms can sometimes turn out to be far more costly when things go wrong.

Also, while transaction fees do influence the returns you get from your investing, they do so far less than other aspects, such as: your ability to not panic sell, your ability to rebalance as planned, the ongoing fees (fund annual costs (TER), account management fees, etc.) and taxes.

But, enough intro and warnings, let’s dive in.

How to choose your online broker

There are different types of brokers:

- Full-service brokers, which provide a full service : taxes, succession planning, wealth planning and financial advice.

- Discount brokers, which charge lower fees and provide access to the exchanges, with a minimum of other services.

Full service brokers are not the best option for index investors, because they are more expensive and offer services we usually don’t need, or will get somewhere else.

Discount brokers are better suited for index investors because cost optimization is an important part of our strategy.

Consider the following criteria when selecting a discount broker :

- Security

- Access

- Convenience

- Cost

1. Security: can you lose all your investments?

The worst nightmare of investors is the loss of their portfolio because of bankruptcy, mismanagement or fraud.

There have been horrible examples in 2008 like the collapse of Fortis Bank in Belgium and the infamous Madoff Ponzi Scheme in the US where thousands of investors lost billions of euros.

And there are still hundreds of examples of scams and frauds uncovered (often too late) by the Belgian authorities.

This is why I repeat all the time that the security of your assets is the number one criteria for selecting your investment platform or broker.

How to protect your investments

Here are the key elements to maximize the security of your assets:

- Make sure your broker is well regulated. This means avoiding brokers that are established and regulated offshore.

- Make sure that your investments are kept in a custodian account, with a separate financial institution and not at your broker. This is called asset segregation and is mandatory for all regulated brokers in Europe. Your assets belong to you and not to your broker. If for any reason it goes bankrupt, your assets are protected.

- Pick a broker with a good reputation. Fraud and mismanagement by the broker is an additional risk to consider. We could not find examples of fraud or mismanagement by brokers that lead to loss of client assets, but it could still happen. Prefer brokers that have demonstrated to put client’s protection and safety first and have a clean track record with the regulators.

- Use the highly secure user authentication methods: 2-step, 2-factor authentication or above. Avoid simple login + password authentication systems or SMS enabled authentication systems. The use of a Digipass or an encrypted app on your phone is the standard.

- Beware of security lending by brokers: in some cases, it could increase your risk exposure for very little gains or benefits.

While security lending is a common and generally safe practice in the fund management industry (most ETFs allow security lending), that is not the case for brokers. It’s generally safer to pick a broker that does not lend your assets.

For example, if you open an account at the Dutch broker DeGiro as a retail investor (Basic account), you agree that your investments can be lent out. You cannot opt out of their securities lending program (most other brokers will give you the choice). Nor can you check in your broker account whether your investments have been lent out or not. With securities lending, the investments are not held by the custodian, because they are lent out to another investor, but the custodian has an obligation (IOU) to DeGiro and so the investor. This can lead to additional risks. You can read more about securities lending at DeGiro in their terms and conditions (article 20 : “Securities Lending”)

The Guarantee and Protection Funds

In case of broker bankruptcy, the regulations mandating asset segregation is the first line of defense against the loss of your investments.

In case that is not enough, your investments with Belgian brokers are protected by the Guarantee and Protection Funds (here in FR and here in NL), in line with the EU Directive 97/9/EC:

- Deposits such as cash and savings are protected up to 100,000 euros, per person per institution, by the Guarantee Fund.

- Investments such as stock ETFs and bond ETFs are protected up to 20,000 euros, per person per institution, by the Protection Fund.

In case of fraud, other administrative malpractice or when an investment firm is unable to meet its obligations due to operational errors, the investor is protected by this investor compensation schemes, and this up to 20,000 euros per person per institution. In some European countries this guarantee is higher, for example up to 70,000 euros in France.

But again, and to quote the Belgium SPF Finance (here in FR and here in NL):

It is important to draw attention to the important legal protection a client benefits from for the securities he has entrusted to his financial institution. Indeed, the customer remains the legitimate owner of his titles and has a right of direct claim on them. This means that the securities must be returned by the curator and therefore can never fall into the bulk of the assets of a possible bankruptcy.

An intervention on the part of the protection system should only be considered if, after the return of all available securities, customers would not have been able to recover some of their assets. Such cases should only occur in the event of administrative errors or other irregularities.

2. Access

This might seem obvious, but you want to pick a broker that gives you access to the investments you want.

Here are the 3 levels of access that you need:

- The broker must be available to you as an investor. Belgian brokers accept Belgian residents, but if you choose a foreign broker, they must accept Belgian residents.

- The broker must give you access to the preferred exchanges. The major ETFs are traded on the Amsterdam, Frankfurt (XETRA) and Borsa Italiana exchanges.

- The broker must give you access to the ETFs you want to invest in.

With the introduction of EU Directive 2009/65/EC on UCITS IV and Commission Regulation 583/2010 brokers can only give you access to ETFs for which the Key Investor Information Document (KIID) is available.

This document contains the most important information about the fund in the language of the investor. Not all brokers have the KIIDs of the ETFs you wish to invest in. And sometimes some ETFs will not be available for other reasons.

Most ETFs people in the FIRE Belgium community invest in are available with all the main brokers. But it does not hurt contacting a broker in advance to check if they have them before opening an account.

3. Convenience

Certain features of a brokerage account can help you achieve your investment goals.

Here are 4 important broker features to consider:

- User experience

- Mobile app

- Customer support

- Tax management

User experience

Not all broker platforms are user-friendly, some look like spaceship cockpits, with far too much information and sub-screens. That’s because many of them are tailored to the needs of active traders.

Index investors prefer simple broker platforms that can be tailored to their needs.

Mobile app

Most brokers have a nice mobile app, but it can be tempting to check your investments all the time, and that’s just what you don’t want to do. Consider uninstalling the app if you find yourself following the market news more than you need.

Customer support

Good customer support is also important. When you’re facing a challenge, that’s where you should go first. Good customer support should be available at the times you need it (not necessarily 24/7) and quick to respond. Visit the broker’s website and ask your questions to their customer service department. We recommend testing phone support service of the brokers you’re considering, as that is where you will go in case you have a real problem.

Take also a look at the FAQ and available documentation on the broker’s website.

Tax management

Delay and mistakes in the payment of investment taxes in Belgium can lead to very heavy penalties.

As I explained at the beginning of the article, I know an investor who had been investing for 2-3 years and did not handle tax declaration and payment properly. The sum of all the penalties when we spoke amounted to about 70,000 euros. This could have been avoided if he had picked a broker that deals with those taxes or if he had managed them properly himself.

Tax management is an important criteria when choosing your broker. You can calculate and pay these taxes yourself, but the process can be complex and delays or mistakes lead to important penalties.

Does the broker deduct the tax on stock exchange transactions (TOB), dividend tax and capital gains tax on bond ETFs?

The main Belgian brokers (Bolero, Keytrade and Saxo Bank) deal with those taxes on behalf of the investor, reducing the administrative work required and the risk of penalties.

With foreign brokers, this is not always the case. Some foreign brokers handle part of the taxes, others not at all.

4. Costs

In the investor community there is an important focus on cost, and that’s correct, but there are other important criteria as described above.

You are sometimes better off paying a little more for security and ease of use rather than simply selecting the cheapest broker.

There are different types of fees a broker can charge. Here are the main ones to consider:

- Ongoing account management fees,

- Transaction fees,

- Real-time market data,

- Security transfer.

Ongoing account management fees

Some brokers charge ongoing costs, such as custody or management fees. These costs will compound over time and negatively impact your returns, usually far more than transaction fees.

Transactions fees

For each purchase or sale of securities, brokers usually charge transaction fees. These costs differ from broker to broker and usually depend on:

- The specific security you are buying or selling

- The transaction amount

- The stock exchange where it takes place

Real-time market data

Most brokers provide 15-minutes delayed market data (including stock prices, volumes, etc.) free of charge and charge for real-time data.

This real time data is important for active traders, but much less so for index investors, as we are long term buy-and-hold investors. The 15-min delayed stock market data is usually sufficient, so no need to pay for real-time market data.

Security transfer

There are 2 ways to move your investments to a new broker

- You sell your securities at broker A and buy them again at broker B. In this case, you pay the transaction fees and taxes associated with those transactions. Keep in mind that the operation can sometimes take a few days.

- You do a securities transfer between the 2 brokers. This is something you can initiate at your new broker and requires the filling of some paperwork and a transfer fee.

Many brokers have promotions to attract new investors and often offer to reimburse some or all of the outgoing transfer fees for your portfolio.

—

I hope this article helps you understand what’s important to consider with picking a broker and that it will help you on your investing journey.

If you’re getting started with index investing, then make sure to watch the free workshop for beginners. I cover all the important aspects of index investing and provide a roadmap to get started.

And if you want specific support for your investing, here [link to general coaching page] is how we can help you.