This has been on my mind for a while now. It seems so simple, yet most people have no idea. So I thought I would try to explain it as simply as possible in one post.

This is not a get-rich-quick scheme, there is real hard work and discipline involved. But while there is no shortcut to building wealth and creating freedom in your life, there are “smartcuts”, things that make the whole process much easier and efficient.

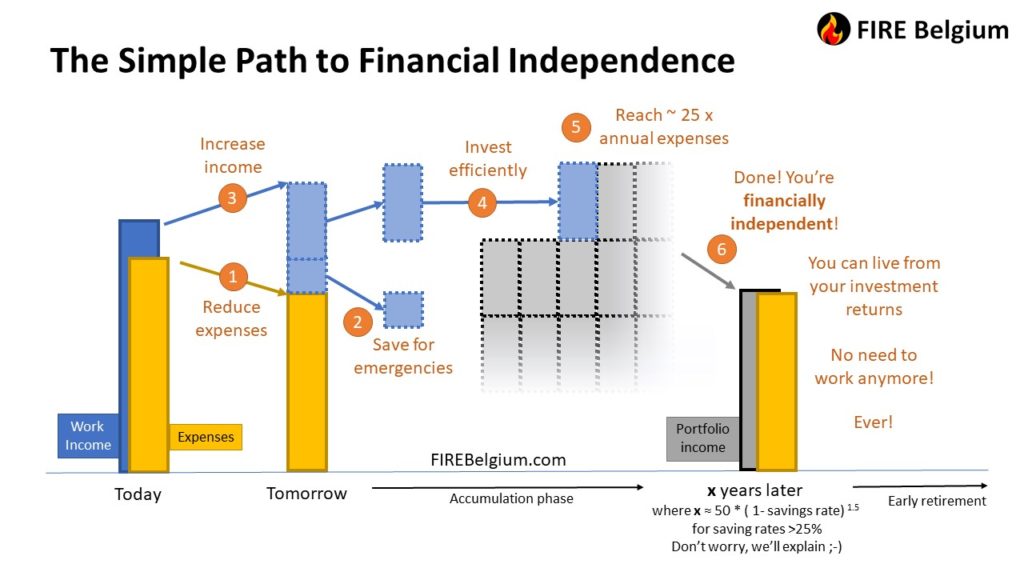

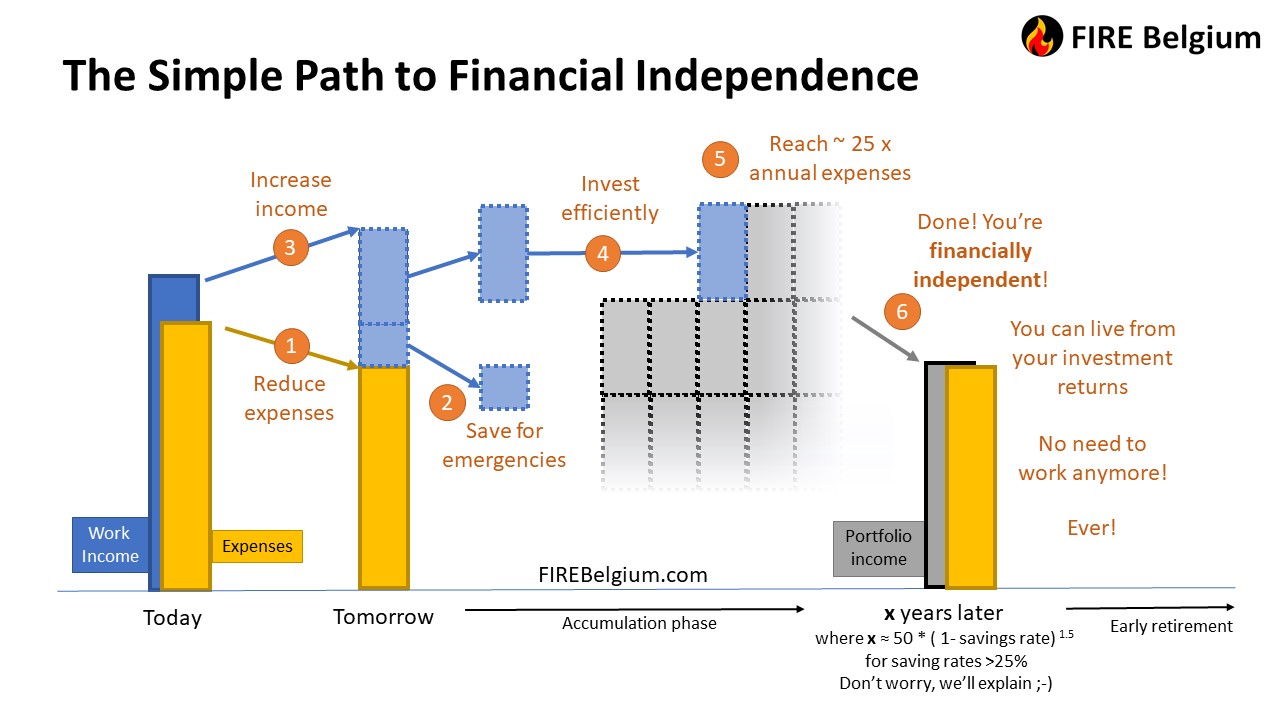

When building this diagram, my goal was to explain how anyone can achieve financial independence (FI) in one single slide. I wanted this to be applicable to the majority, so it builds on what most people already have (an income) and makes use of it in a simple way (learning and starting to invest in index funds can be done in just a few weeks with the right resource).

So, this diagram aims to answer the question “How do you get to a situation where you don’t have to work for money, following a few simple steps?”

What do you think? Does it summarize it well? I would love to hear your feedback. And if anything is unclear, please let me know as well!

And if you’re interested in this topic and want to go further, I invite you to watch the recording of my talk on the topic: The Simple Path to Financial Independence: How to Build Financial Security and Freedom in your Life.

So here are the 6 steps to build wealth and reach financial freedom.

1. Reduce expenses

I see the “Wow, you’re teaching me something new there Sebastien!” coming, but you would be surprised to know how many people are living paycheck to paycheck, sometimes taking loans or getting into debt so that they can spend money they have not earned yet. Yes, in Belgium too.

Reducing expenses is an essential step if you’re considering improving your financial situation. Having those expenses under control, knowing where your money is going is the first step to financial independence. How much you spend and on what you spend is in your control. If you’re not tracking your expenses and trying to reduce them, you should start right now.

As you reduce your expenses, you increase your savings, freeing up money for your emergency fund and your investment portfolio.

In addition to increasing your savings, reducing expenses also means you reduce your cost of living and will therefore need less passive income to declare yourself financially independent. It really is the foundation of financial independence, so much that sometimes people confuse FI with frugality.

Here are simple but highly effective ways to get started:

a. Track your expenses, make sure you know where every euro/dollar is going!

- Use an expense tracker app (there are many great apps available for free)

- Use a spreadsheet and record every expense and income

- Review your monthly bank statements and classify your expenses into categories

b. Understand that every euro you spend today is traded for freedom and opportunities in the future. The larger the amount, the bigger the trade-off.

c. Analyse your expenses and consider whether each of these are essential to your goals and well-being. What is more important: spending on this now, or building your financial security and future freedom?

d. Consider the big expenses and think about ways you could reduce them. The biggest wins will come from these big changes. One of my friends likes to say that it is important to trim the FAT:

- F: Expenses related to Food and drinks, especially if you go out a lot

- A: Expenses related to your Accommodation. Moving to a cheaper/smaller place can translate in decades of reclaimed freedom! And if you’re resourceful, explore things like house hacking!

- T: Expenses related to Transport, especially if you are in the habit of buying a new “over-sized” car every few years.

2. Save for emergencies

Once you’re able to save money, the next step is to build an emergency fund as fast as possible. This is money that will serve as a buffer, should something unexpected happen. For example: you lose your job or are forced to take a pay-cut (very relevant at the moment!), an unexpected expensive repair is needed, you have to take unpaid leave to take care of a family member, etc. Depending on how stable your situation is, the general advice is to have between 3 and 6 months of expenses saved up. The key here is that this money is available at a moment’s notice and not invested in anything risky.

It is highly recommended you have your emergency fund fully built up before you start investing seriously. You never want to be in a position where you are forced to sell your investments, especially not during tough times.

3. Increase Income

Increasing income is the other very obvious way to increase your savings. This is however often more difficult to accomplish than reducing your expenses. Here are two powerful ways to boost your income: focusing on your career and starting a business.

Focusing on your career. This seems obvious, but a lot of people forget that their main asset is their ability to earn an income. For the vast majority of people, this is the most viable route to increasing their wealth, because it is their main (and often only) source of income. Increasing work income requires hard work, solid social skills, a focus on quality and continuous education. It’s hard but it pays off. The good news is, a lot of people are already working on this as it is rather obvious.

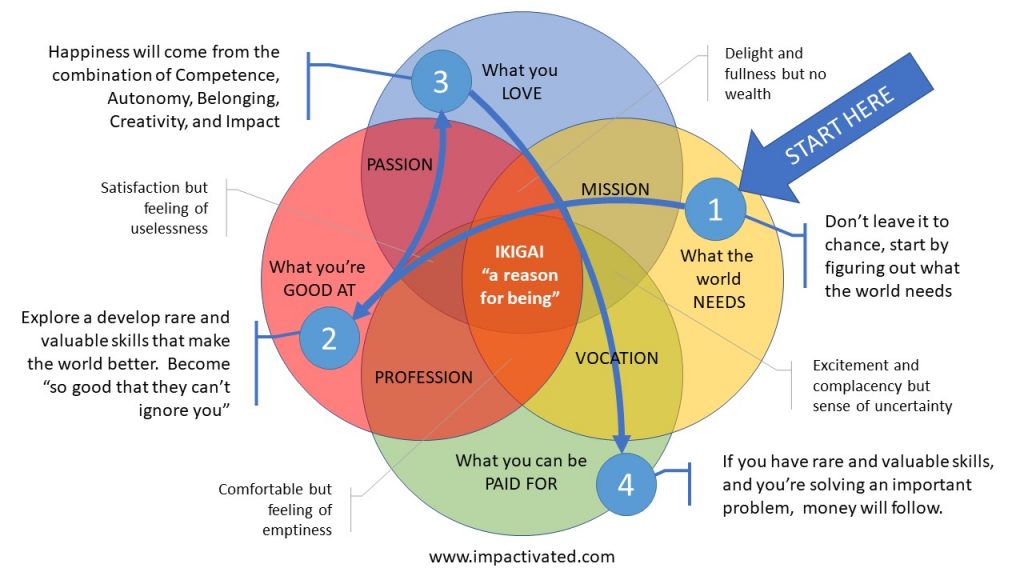

To be successful in increasing your income it is important to be strategic. To take your head out of the grind and think carefully about where you’re going.

Here are several ways to increase how much you’re getting paid:

- Provide more value: the better we are at what we do and the more valuable we become to our employers, the more likely we are to get paid better. And I believe we have better chances at providing value if we become good at solving an important problem.

- Select or change towards a higher paying role or industry

- Increase your value and productivity by focusing on what matters most at work (i.e. with the 80/20 rule)

- Know your value and ask to be compensated accordingly.

It’s also important to realize that to make an extra ordinary income, you have no choice but to make extra ordinary choices. It is often the jobs that other people cannot or don’t want to do that pay the most. Examples of this are off-shore jobs and expat jobs. They tend to pay much more than regular jobs in Belgium.

Other ways to increase your income include starting a business or a side hustle.

If you have an entrepreneurial spirit, you can decide to invest your time and resources in your own business. Traditionally, this is how most self-made billionaires have become wealthy. This is a high-risk high-reward approach to building wealth. Some people spend their lifetime launching startups and building businesses without ever becoming wealthy or generating passive income. Some other (in very rare cases) become millionaires in just a few years. If done well, entrepreneurship is potentially the fastest way to become wealthy. Once you’ve built a business, you can either delegate the management and try to make it passive (this is not an easy process), or you can sell it and generate passive income by investing the proceeds intelligently.

If you’re interested in starting a business, with as little upfront investment possible, I highly recommend checking out Rebel Business School. And a great place to learn about starting an online business is Smart Passive Income.

4. Invest efficiently

When thinking about investments, most people picture either real estate, or risky stock market picking strategies…

While it can be very powerful if you find the right deals and use leverage properly, I find that real estate investing requires too much work and involves too much risk for the potential return.

What I like is long term buy and hold low cost index investing. This is a method that seems to be less understood by most people. This is mostly because the stock market is depicted in the media as a risky way to make money, often compared to gambling money in casinos. Another reason is that investing in the stock market used to be something only the very wealthy could do. But thanks to the work of John C. Bogle, the founder of Vanguard Group, and the rise of index funds (in both mutual fund and ETF form) and online brokers, investing is now something almost anyone can do. If you follow the simple and effective Bogleheads’ approach to investing, then you can expect long-term returns of between 6 and 9% per year, with minimal effort.

For me, this is clearly the most efficient way of investing. It takes far less work to invest money well than to earn that money in the first place. This is so important, let me repeat it: Investing effectively is much easier than earning an income. It takes between a few weeks to a few months to learn how to and start investing effectively and then maybe half-hour every month. And on average, you can expect this simple approach of investing to double the value of your portfolio every 10 years or so.

The key is to learn the basics, build a solid investment plan and then simply follow it. We build a portfolio of low cost index ETFs (you only need 2!), with the right asset allocation between stocks and bonds so that it can withstand and perform well in any kind of market situation.

This is the most passive and the most effective way I have found to invest and build freedom in my life. There is no need to follow the news, track the markets, change strategies, pay expensive advisers or professional managers, etc.. Index investing is a simple set-it and forget approach that beats most professional investors and managers over the long term, without having to do much work. I simply make a transfer every month or two, invest and then forget about it.

In addition to the Bogleheads wiki and forum, I also highly recommend JL Collins Stocks Series as well as his book. For expats around the world, I highly recommend Andrew Hallam’s book and for anyone based in the Middle East, I recommend joining the SimplyFI community and if you’re based in Belgium, make sure you join the Financial Independence Belgium community. Also, I have developed a Beginner’s Guide to Index Investing which you can get here.

5. Reach ~ 25 x annual expenses

Ever since the publication of the Trinity Study in 1994, there has been a lot of research on how long a balanced portfolio of stocks and bonds can last in retirement.

This has led to the now rather famous 4% rule of thumb, which basically states that if you withdraw between 3 and 4% (adjusted for inflation) of your portfolio every year, the portfolio has good chances of enduring forever. This approach to early retirement was made very popular by MMM’s The Shockingly Simple Math Behind Early Retirement. This is probably the blog post that changed my life the most. For more advanced reading on the topic I recommend reading the Safe Withdrawal Rate Series by BigERN.

And so, this is how we generate passive income from the stock market. For every 1,000 USD invested wisely, we calculate that it can generate between 30 and 40 USD per year forever. So, if you have 25 to 33 times your annual expenses invested Bogleheads style, you’re financially independent! It’s that simple!

Now, obviously the exact number will depend on many personal aspects, including other income sources (pension, etc.), expected lifestyle changes, taxes, etc.

If you’re fan of financial independence, I also recommend you check out the following podcasts: ChooseFI, Earn and Invest and Financial Independence Europe.

6. Done! You’re financially independent

And then boom! You’re FI. 🔥🔥🔥

Best. Life. Hack. Ever.

While for many this seems to be the end goal, FI really is only the beginning of an extraordinary adventure!

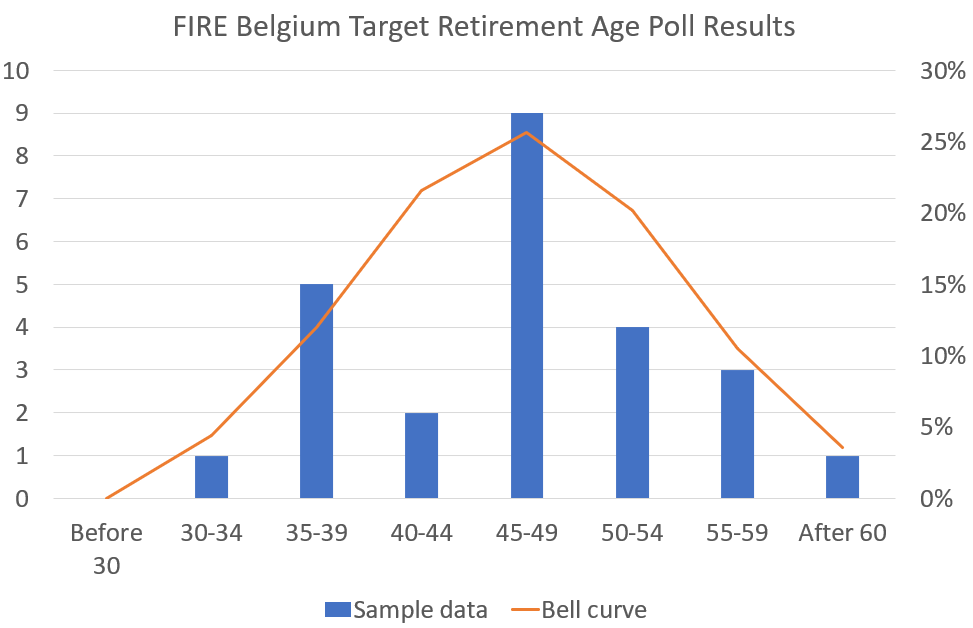

All of a sudden, you have reclaimed back and freed 9 to 10 hours of life per day. 5 days a week. Every week. For the rest of my life. In the Financial Independence Belgium Facebook group, on average people plan on retiring 20 years before the traditional age.

That is 20 additional years of life (that’s 7,305 days or 175,320 hours!) and freedom that did not exist a few years earlier.

20 additional years to be present and live fully with your family.

20 additional years to learn, think, explore, travel, discover and live life to the fullest.

20 additional years to learn, focus and take action to make the world a better place.

Often people start by taking some time to recover and take care of themselves and their loved ones. You reflect on your life and think about what matters most.

And that is when you realize that financial independence is not just an armor, it is a true superpower.

You now have the freedom to decide to do with your time, without having to work for money. You can focus on what matters most, without having to divide your attention between that and making a living. What you can now do is pretty much only limited to your imagination 🙂

Many of us decide to use our FI superpowers to make the world a better place. We have incredible skills, time, resources and a mind free of money concerns and we can make a big difference by focusing on doing the most good possible. We call it #FIforImpact: Using FI to make the world a better place.

Thanks for sharing your knowledge.

Glad you find it useful Geert!